Posts

If you’lso are searching for a new, comprehensive banking choice, SoFi’s checking and you will savings accounts feature no account charges, higher-than-average APYs and you can an invaluable bonus provide. Or even meet the standards to make step 3.80% APY2, your own APY will be proper 1.00% APY on the offers equilibrium, that is nevertheless greater than costs given by of a lot conventional banking institutions. Along with, you earn 0.50% APY to your checking balances, regardless of whether you create lead put.

More words, conditions, and you may limits apply to the hole out of and you can and make places to your Qualified HISAs. People have to meet the criteria lay by Simplii Monetary to open otherwise hold a qualified HISA so you can qualify for the brand new HISA Offer. Put your savings in the quick lane which have great prices and you may zero monthly charge. It was sent to me thru email also it appears to had been received by many anyone else from what We’ve been reading in the fresh Reddit community forums.

The new Altitude Link Visa Trademark Credit has numerous ways to earn bonus issues for the purchases in the popular kinds, along with rooms, travel, gasoline, shopping and a lot more. The new Blue Company As well as Cards away from Western Display is a wonderful discover to possess quicker business owners trying to find a balance out of cost and pros, with good perks and you will a selection of team rewards. Just observe that you will find an advantages paying limit, which may never be an informed complement huge organizations that have larger finances. You’ll also earn 5% money back on the supermarket orders (leaving out Address and you may Walmart) for the to $several,100000 invested in the first season, and that compatible a possible $600 extra incentive for those who max the bonus.

Greatest credit cards to have sign-up bonuses out of February 2025

To make the main benefit inside the given timeline, you simply discovered regarding the $167 directly in places thirty day period; for many who discovered biweekly paychecks, that might be only $83.50. A money deposit, report borrowing, travel orders, provide cards or even charity providing are common high possibilities. For those who’lso are pairing the new Chase Liberty Limitless along with other Pursue playing cards, such as the Sapphire Reserve otherwise Well-known, you could potentially import their welcome incentive benefits these types of cards to own far more rewarding redemption choices. Earning up to $3 hundred in the cash return while the a welcome incentive is actually a fairly a great render, however, earning 6.5 % back to your take a trip purchased because of Chase Travelling are a great huge (and rare) cheer to have a cards with no annual commission. Keep in mind that which acceptance offer is one of the top-level now offers with no-annual-commission cards since the the brand new cardmembers still obtain the increased perks on the what you it invest as much as $20,000.

- In person, I opened a number of Dvds and you may a couple of discounts profile because of all of them with zero issues.

- Carrying a cards one brings in transferable issues is vital to a good effective points approach.

- Whilst you may well not get the unique advantages out of premium profile, you could potentially take advantage of overdraft protection in the event you affect overdraw and you can Chase’s broad network away from percentage-100 percent free ATMs.

- For more information, comprehend all of our complete overview of the main city You to definitely Venture Rewards card.

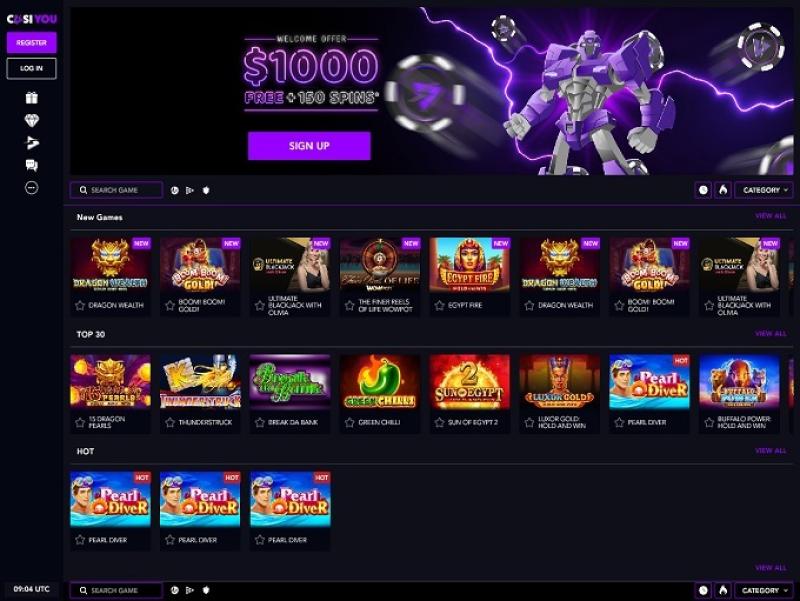

You also get $300 https://mrbetlogin.com/beverly-hills/ matches bonuses, 300 totally free revolves offers, and other 300 added bonus also offers. With regards to bonuses and $3 hundred no-deposit offers you’ll find crucial conditions for example wagering requirements one to determine if it’s a render or perhaps not. Betting conditions will be the amount of minutes you have got to gamble via your extra one which just move they to help you real money and make a detachment. Other give of a lot participants see ‘s the 3 hundred free revolves no deposit offer. This permits you to definitely play for 100 percent free when you check in an excellent the brand new athlete account. You get to are the brand new gambling establishment, the new video game and you can best slots ahead of investing real cash.

Finest Company Deals Profile from 2025

Specific bonuses come with large investing standards, steep yearly charge, or restrictive redemption options, that are not a challenge if your investing designs align. But always investigate terms and conditions so that the credit suits your way of life and you will paying models. Usually, you can generate a welcome added bonus provide multiple times, although it relies on the fresh cards.

The fresh deposit criteria is higher for every extra tier, nonetheless it’s definitely worth they if you have the bucks this is when’s as to the reasons. Earn an advantage of $three hundred, $750, otherwise $1,five hundred for how far you put in the first 15 days of membership opening. The Chase incentive would be placed to your account immediately immediately after you done all criteria within the said time and you can from the provide deadline. J.P. Morgan Wealth Administration is a corporate from JPMorgan Chase & Co., which supplies funding services due to J.P.

The new cardholders qualify to your biggest acceptance to your Chase Sapphire Well-known Credit. For a limited go out, which lover-favorite cards provides a just-ever before added bonus of one hundred,100000 extra points after using $5,100000 to the requests in the 1st 3 months from membership starting. The brand new Sapphire Popular’s offer typically consist up to sixty,one hundred thousand points, making it a great monumental improve.

SoFi conditions and terms

Department of your own Treasury and completely backed by a full faith and you will credit of your You.S. regulators. Rates are determined because of the rising prices – while you are inflation is damaging to the newest savings, it’s great for I Ties. You are able to hook an outward checking account within minutes and you can build seamless transmits between your connected membership. People means a family savings, even when you’lso are in between group or very rich.

Jake try an entire-date Article Strategist to have Motley Deceive Money, focusing mostly to the our articles production and you will distribution streams. The guy specializes in the matter handmade cards and you will desires to make sure differing people gets the finest credit to them. While you are paying the past a decade editing economic posts, he’s the capacity to spend a whole date tailgating, the shortcoming for taking themselves also undoubtedly, and you may life that have a putter he’s maybe not currently speaking-to. Constantly, you will get the brand new welcome incentive give to suit your the fresh cards within the the newest report when you meet with the minimal using demands, which is the amount of money you ought to devote to the new credit to discover the acceptance bonus offer.

Hedge with Crypto aims to publish advice which is truthful and you can direct by the new go out from guide. To own particular information regarding a cryptocurrency change or trading system delight see one seller’s webpages. This post is standard in nature that is to own informative intentions merely.

Get a plus away from $three hundred, $750, or $step one,five hundred according to your complete deposit matter. The new Chase Safer Bank account is a good option for anyone who would like to prevent fees. Rather, it offers no overdraft percentage and you can a monthly service commission away from simply $cuatro.95, which is easily avoided. The new Bluish Dollars Preferred Credit of Western Share now offers among the better money back rewards during the U.S. food markets, in addition to a good room away from consumer insurance coverage professionals. Although this code doesn’t appear to hop out much in order to interpretation, particular customers has stated getting the bonus even with had the cards in past times. In some cases, when it’s become a really while (7+ years) because you’ve encountered the cards, American Share can get choose you could secure the main benefit once more.

Other variables, including our very own exclusive site’s laws and regulations plus the odds of applicants’ borrowing approval along with feeling exactly how and you can in which points show up on the brand new site. Jessica Merritt is actually a personal money author which have 8 many years of experience coating playing cards, banking, and you may economic wellness. She focuses primarily on flipping advanced financial information on the obvious, actionable information, that have performs looked inside the U.S. More guaranteed means to fix strike the threshold is always to funds requests ahead of time. Regular monthly expenditures can often cause you to your need invest, rendering it easily achievable so long as you make sure to make use of the newest card to own sales.